35+ are mortgage points tax deductible

Mortgage points or. Web Generally you cannot deduct the full amount of mortgage points in the year paid as they are considered prepaid interest and must be deducted equally through the.

Tax Credits For Homeowners Homeowner Tax Deductions Explained

Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions.

. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert.

Web Mortgage points are considered an itemized deduction and are claimed on Schedule A of Form 1040. Web Are mortgage points tax-deductible. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

As far as filing taxes goes claiming a tax deduction for mortgage points is a fairly straightforward process. Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat. 35 for incomes over 204100 408200 for married couples filing jointly 32 for incomes over.

However if you refinance with the same lender. You can deduct any mortgage interest that you pay on up to 750000 of debt any points you had to pay to get your. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web If you meet all the above criteria you can either deduct all your points in the year you paid them or deduct them in equal increments over the life of the loan. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

Web Is mortgage interest tax deductible. Here are the specifics. Mortgage points are considered.

Web How to Deduct Points. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950.

The standard deduction for married. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Web Is mortgage insurance tax-deductible.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now. Homeowners who bought houses before December 16.

Usually your lender will send you Form 1098 showing how much you paid in mortgage points and mortgage interest during. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web The IRS considers these discount points to be prepaid interest which generally makes them tax deductible in the year you pay them if you meet these.

Web Up to 96 cash back If you refinance with a new lender you can deduct the remaining mortgage points when you pay off the loan.

Mortgage Points Deduction Itemized Deductions Houselogic

Mortgage Points A Complete Guide Rocket Mortgage

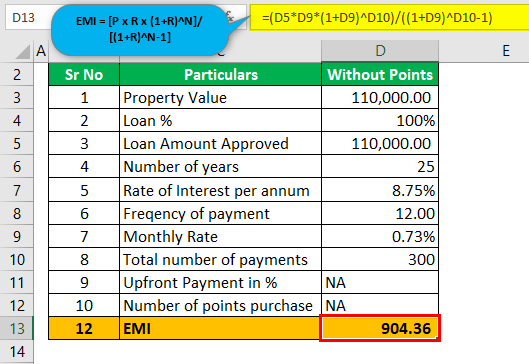

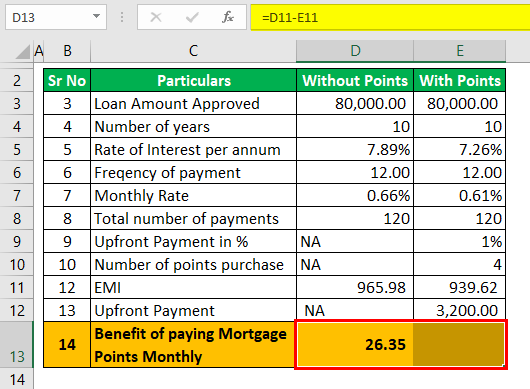

Mortgage Points Calculator Calculate Emi With Without Points

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

What Is The Schedule 1 Tax Form Quora

Ing International Survey Homes And Mortgages 2017 Rent Vs Own

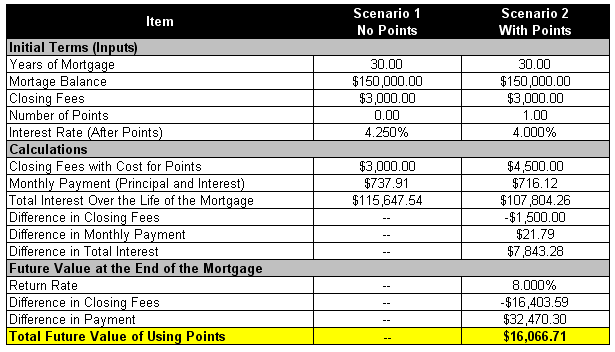

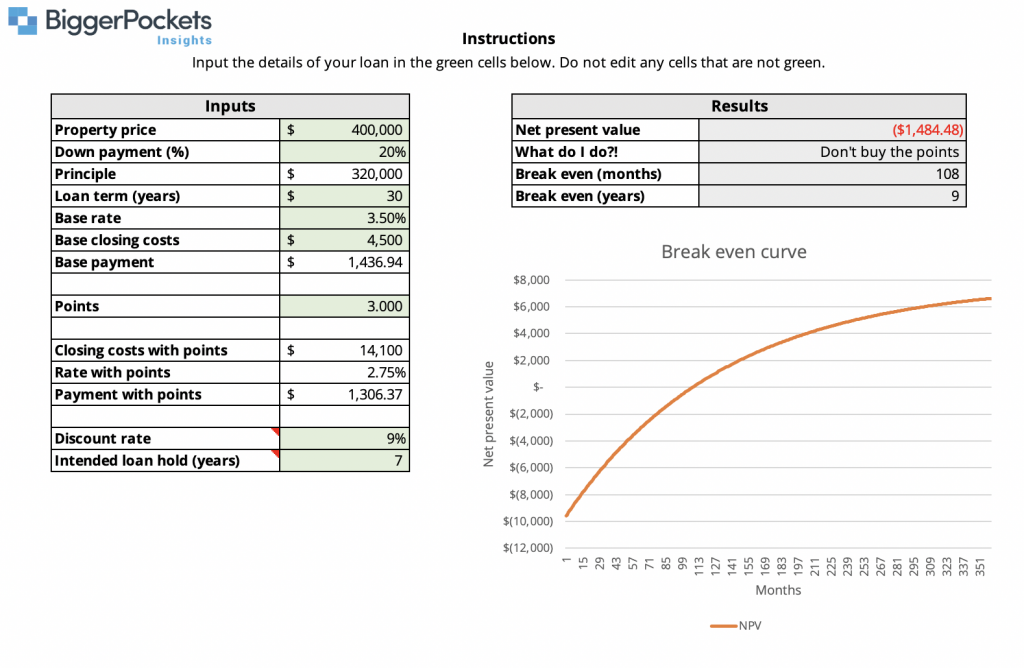

Should You Pay Mortgage Discount Points

Aug 17 2012 Kaiserslautern American By Advantipro Gmbh Issuu

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

I Paid No Federal Income Tax For Last Year Is That Fair Without Bullshit

Mortgage Points Deduction Itemized Deductions Houselogic

Mortgage Points Calculator Calculate Emi With Without Points

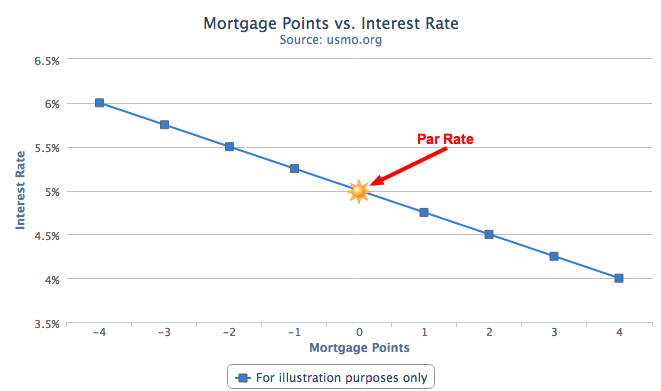

Understanding Mortgage Points U S Mortgage Calculator

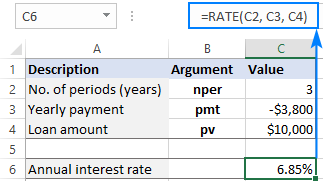

Using Rate Function In Excel To Calculate Interest Rate

Discount Points Calculator How To Calculate Mortgage Points

Maximum Mortgage Tax Deduction Benefit Depends On Income

Used Farm Equipment Pricing Guide 5 Key Points